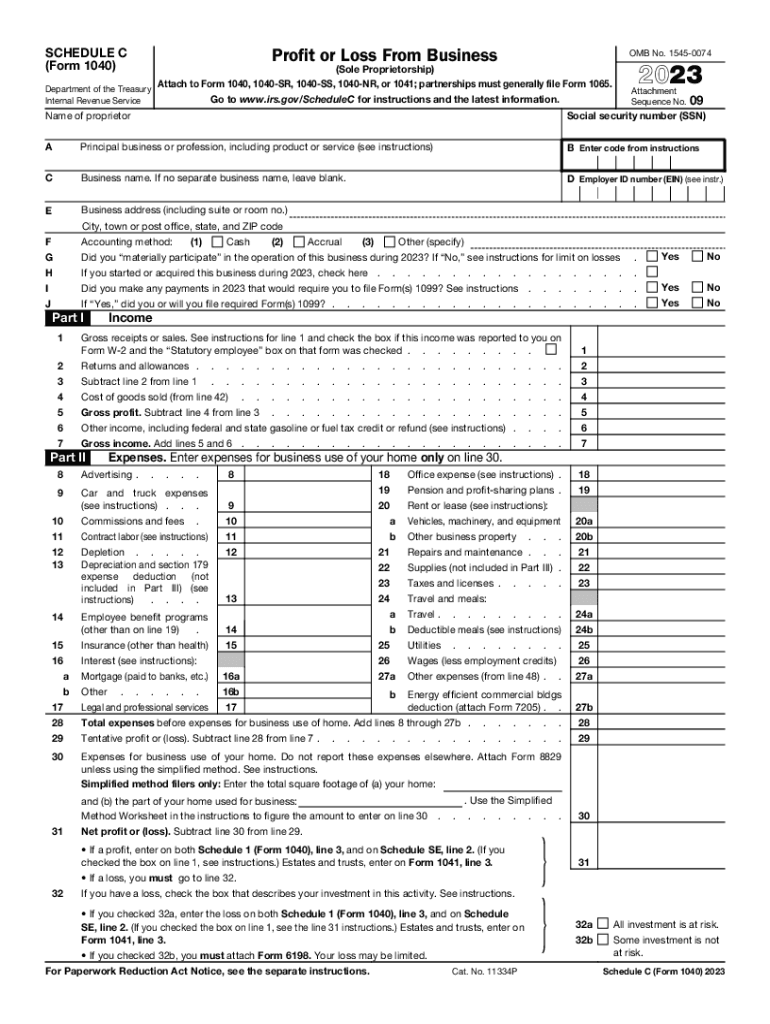

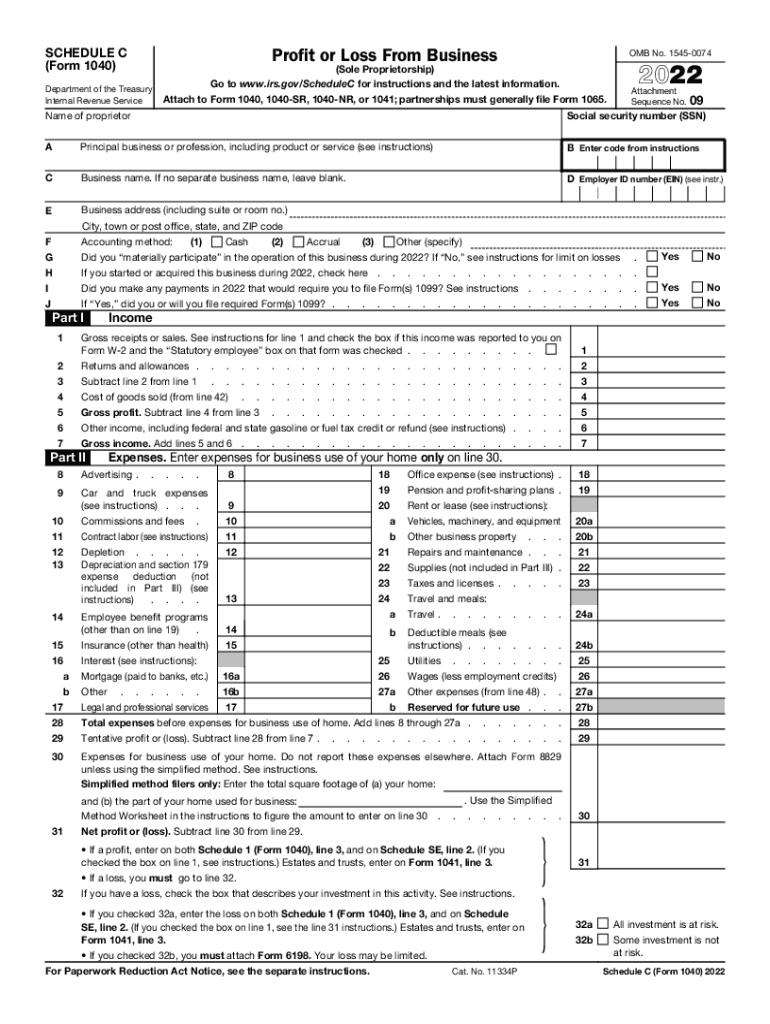

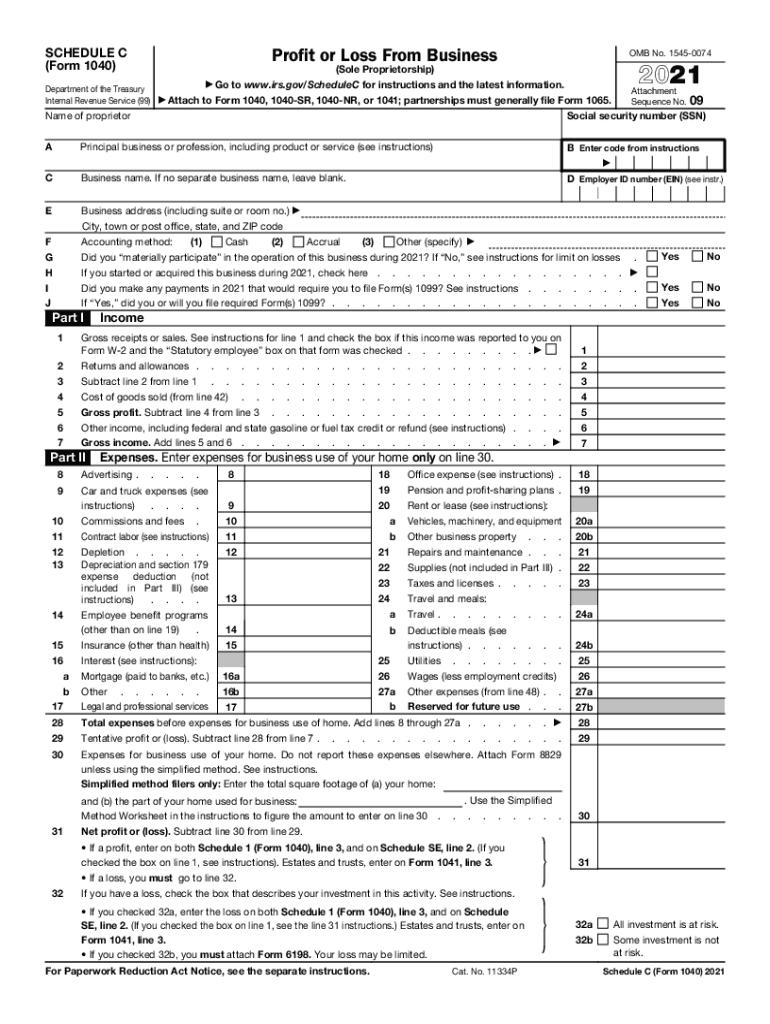

2024 Form 1040 Schedule C Instructions Printable – The 1040 2023 Instructions instruct all taxpayers to answer the digital they must report that income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Schedule C is . To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are .

2024 Form 1040 Schedule C Instructions Printable

Source : irs-schedule-c-ez.pdffiller.comHarbor Financial Announces IRS Tax Form 1040 Schedule C

Source : www.kxan.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comSchedule C (Form 1040) 2023 Instructions

Source : lili.co1040 gov: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comSchedule C (Form 1040) 2023 Instructions

Source : lili.co1040 schedule c: Fill out & sign online | DocHub

Source : www.dochub.com2023 Instructions for Schedule C

Source : www.irs.gov2024 Form 1040 Schedule C Instructions Printable 2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable : Business Revenue and Expenditures If you operate a business as a sole proprietor, you declare income on the standard Form 1040 rate given in the Schedule C instructions, or you can claim . Much has already been written about the Flexibility Act, SBA Interim Rule changes, and EZ Forgiveness Application and instructions that file a Schedule C to a Form 1040 of the owner or .

]]>