Cpp And Ei 2024 – which is $17,777 excluding Canada Pension Plan (CPP) and Employment Insurance (EI) deductions. Now let’s assume you made an RRSP contribution of $8,000. This would reduce your taxable income to . Understanding your tax bracket and rate is essential regardless of your income level. We explain the difference between your federal and provincial tax rates and ways to reduce your taxable income. .

Cpp And Ei 2024

Source : blog.hireborderless.com2024 CPP & EI Rates Changes For The New Year | Virtus Group

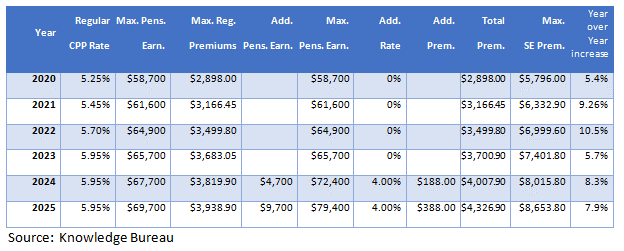

Source : virtusgroup.caKnowledge Bureau World Class Financial Education

Source : www.knowledgebureau.comCPP & EI Max 2023 2024 What is the Max EI and CPP Contribution

Source : www.incometaxgujarat.orgMax 2024: How CPP, CPP2 and EI Rates Compare to Inflation

Source : www.canajunfinances.comBusiness owners brace for second stage of CPP expansion

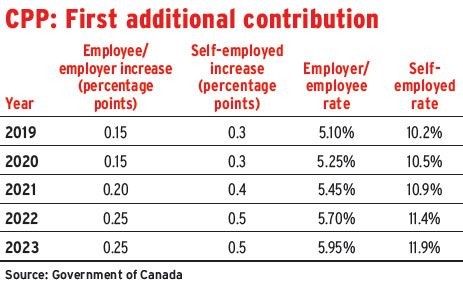

Source : www.investmentexecutive.com2024 CPP & EI Rates Changes For The New Year | Virtus Group

Source : virtusgroup.caMax 2024: How CPP, CPP2 and EI Rates Compare to Inflation

Source : www.canajunfinances.comCPP and EI Payroll Rates and Information for Employers (2024

Source : blog.hireborderless.comEmployers and the 2024 CPP changes Canada.ca

Source : www.canada.caCpp And Ei 2024 CPP and EI Payroll Rates and Information for Employers (2024 : Canada Pension Plan (CPP) or Quebec Pension Plan (QPP), Employment Insurance (EI), and Quebec Parental Insurance Plan (QPIP) deductions. For all other purposes, including, where applicable . Life and disability insurance tends to be dropped in retirement, and pension, registered retirement savings plan (RRSP), Canada Pension Plan (CPP) and employment insurance contributions disappear. .

]]>.png)